30-Year Mortgage Rate Drops to 6.67% — Best Since April

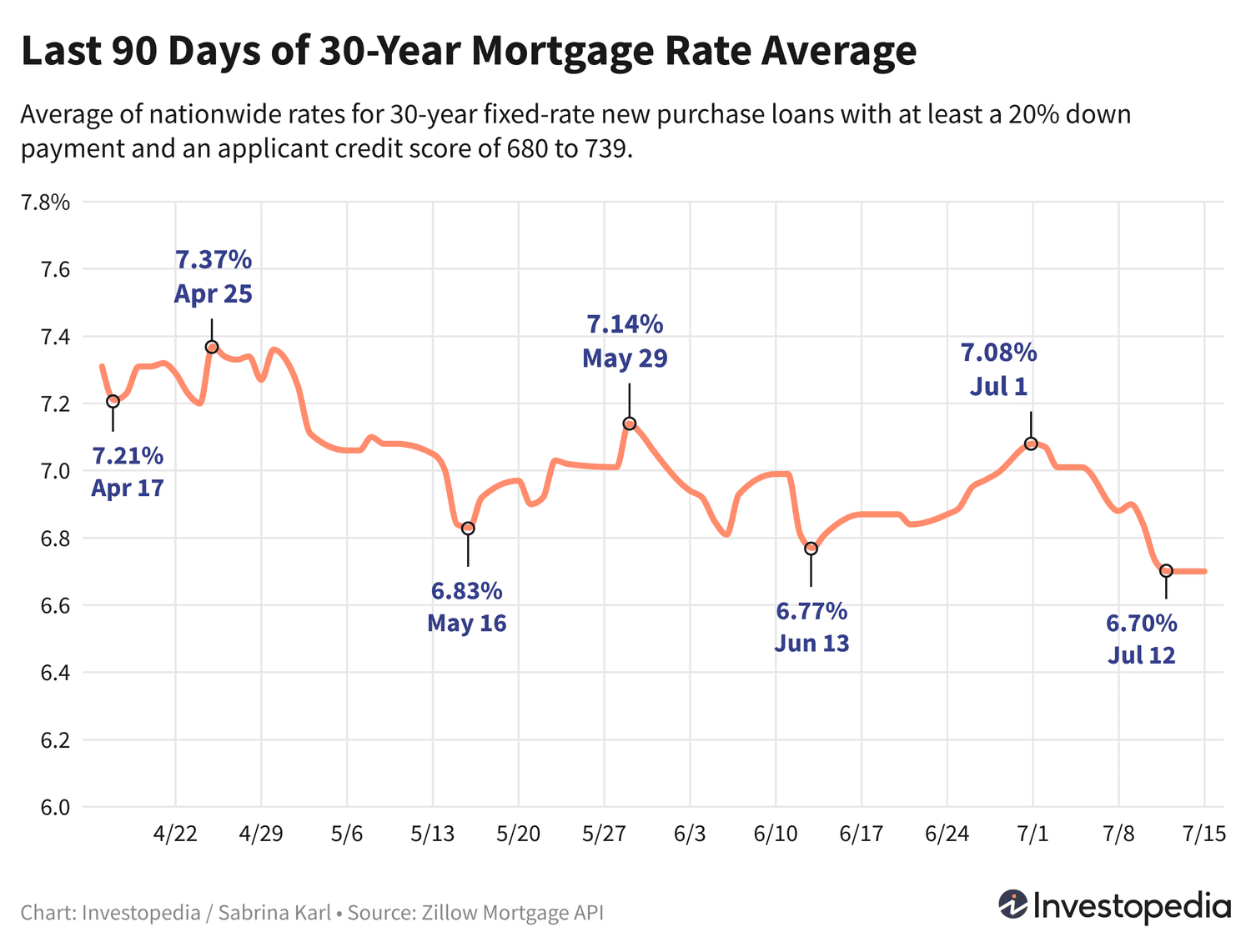

Mortgage Rates Hit 3-Month Low, For the fifth week in a row, the average 30-year mortgage rate in the United States has declined, offering a glimmer of hope to frustrated homebuyers. According to Freddie Mac, the average rate dropped to 6.67% this week, the lowest since early April and a notable dip from 6.77% the week before.

Just one year ago, mortgage rates were hovering around 6.95%, and while today’s rate is still relatively high historically, the downward trend marks a welcome shift in a market plagued by soaring home prices and stagnant sales.

A Market Desperate for Relief

The housing market has suffered under the weight of high mortgage rates since late 2022. Homebuyers — especially first-time buyers — have been sidelined by unaffordable monthly payments. Even modest reductions in mortgage rates can significantly improve purchasing power, putting more homes within financial reach.

Homeowners looking to refinance are also seeing benefits. The average rate for a 15-year fixed-rate mortgage fell to 5.80%, down from 5.89% last week and from 6.25% a year ago.

Long-Term Pressure on Sales Could Ease

The persistent slump in home sales dates back over two years. In 2023, sales of previously owned homes reached their lowest point in nearly three decades. So far in 2025, sales activity has remained sluggish due to high prices and borrowing costs.

However, the recent dip in rates may signal the start of a market rebound. According to the National Association of Realtors, pending home sales rose 1.8% in May, a potential preview of stronger numbers in the coming months. Year-over-year, pending sales are up 1.1%.

Pending sales are a key indicator, since there’s typically a one- to two-month lag between a signed contract and a finalized sale.

Why Rates Are Falling — And What Could Happen Next

Several key factors influence mortgage rates. Chief among them is the Federal Reserve’s monetary policy, but bond yields also play a critical role.

The 10-year Treasury yield, a benchmark for mortgage pricing, stood at 4.33% as of Thursday — down from a recent high of 4.58%. This decline in yields has contributed directly to the drop in mortgage rates.

Economists expect rates to stay in the 6% to 7% range through the end of 2025. That stability could encourage more buyers to reenter the market, particularly if inflation remains in check and economic growth stays steady.

Applications on the Rise

The lower rates are already having a psychological impact. According to the Mortgage Bankers Association, mortgage applications rose 2.7% last week — a sign that demand may be stirring again.

This uptick could reflect both home purchases and refinancing activity. While many homeowners locked in ultra-low rates during the pandemic, those with higher-interest loans are now eyeing a potential opportunity to refinance at a lower cost.

New Homes Still Struggling

Despite the encouraging signs, the new-home market continues to face headwinds. In May, new home sales dropped nearly 14% from April, based on government data. High construction costs and limited inventory are keeping new builds out of reach for many families.

Still, if mortgage rates continue to drift lower, builders may see increased interest — especially from buyers frustrated by the tight resale market.

Final Thoughts: A Slow Climb, Not a Surge

This five-week streak of falling mortgage rates is a breath of fresh air for the housing market. Yet experts urge caution. While rates are easing, they’re still double what they were during the pandemic’s peak buying frenzy.

In short, the U.S. housing market isn’t flipping a switch — it’s turning a slow corner. Stability and incremental gains will define the months ahead, not a sudden boom. Still, for buyers who’ve been waiting on the sidelines, this could be the moment they’ve hoped for.

For more latest news checkout our website: usnewsinsight