A Historic Win for Main Street Entrepreneurs

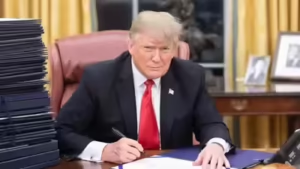

Tax Relief for Small Businesses, In a major policy breakthrough, President Donald Trump signed the One Big Beautiful Bill Act into law on July 4, 2025. The legislation makes the 20% Small Business Tax Deduction permanent, shielding millions of small businesses from a looming tax hike.

The National Federation of Independent Business (NFIB), representing over 33 million small business owners, applauded the decision. This permanent deduction provides long-term certainty, encourages growth, and enhances job creation.

The End of Uncertainty for Small Businesses

Since 2017, small businesses have relied on the 20% deduction to reinvest profits. That critical tax break was at risk of expiring this year. If Congress hadn’t acted, tax burdens would have skyrocketed for pass-through businesses nationwide.

Thanks to the new law, owners now have a stable tax environment. They can focus on expanding, hiring, and serving their communities.

New Expensing Limits Fuel Equipment Investment

One of the most powerful provisions of the bill is the increase in the Section 179 expensing cap. The threshold rises from $1.25 million to $2.5 million.

This change enables small businesses to fully deduct the cost of equipment purchases in the first year. That means better machinery, more efficient operations, and faster growth—all tax-advantaged.

Permanent Tax Rate Cuts Provide Lasting Benefits

Another key element of the bill is the permanent extension of marginal tax rate reductions enacted in 2017. Without this change, five out of seven individual tax brackets would have increased by year’s end.

Most small businesses file as pass-through entities and are taxed at individual rates. Making these rate cuts permanent is a direct win for Main Street operators and family-run firms.

Estate Tax Reform Secures Generational Wealth

The legislation also modernizes and makes permanent the Small Business Estate Tax Exemption. The new limits are $15 million for individuals and $30 million for joint filers.

This provision allows family businesses to be passed on without heavy estate taxes. That’s a major step toward long-term economic stability for entrepreneurs and their heirs.

Business Owners Applaud Trump’s Bold Leadership

NFIB President Brad Close stated, “President Trump and Congress have the gratitude of 33 million American small business owners.” He emphasized that this bill strengthens not only small businesses but the entire national economy.

From mom-and-pop shops to mid-sized manufacturers, the One Big Beautiful Bill Act is sparking hope and confidence across all sectors.

Conclusion: A Game-Changing Tax Victory for America

This legislation marks one of the biggest tax wins for small businesses in American history. The permanence of the 20% deduction, expensing upgrades, and estate tax reforms deliver lasting stability.

President Trump’s bold move is energizing the backbone of the U.S. economy. With predictable tax policies now in place, America’s small businesses are ready to thrive.

For more latest news checkout our website: usnewsinsight