Historic Surplus Achieved Through Strategic Trade Policies

Trump Tariffs Shatter Records, For the first time in American history, U.S. customs duties have surpassed the $100 billion mark in a single fiscal year. Fueled by President Donald Trump’s aggressive tariff policy, this surge in trade revenue delivered a shocking $27 billion federal budget surplus in June, reversing a massive deficit from the same month last year.

Customs Duties Hit Unprecedented Levels

In June alone, customs duties skyrocketed to $27.2 billion on a gross basis, or $26.6 billion after refunds. These figures not only break records but also showcase how Trump’s tariff strategy is now a primary source of income for the federal government.

With nine months of fiscal 2025 completed, gross collections have soared to $113.3 billion, while net customs duty revenue reached $108 billion — nearly double last year’s intake.

Tariffs Emerge as Major Federal Revenue Stream

Tariffs now rank as the fourth-largest revenue generator for the federal government. Only withheld individual taxes ($2.683 trillion), non-withheld individual receipts ($965 billion), and corporate taxes ($392 billion) surpass them.

In just four months, tariffs’ share of total federal income has more than doubled, jumping from 2% to nearly 5%.

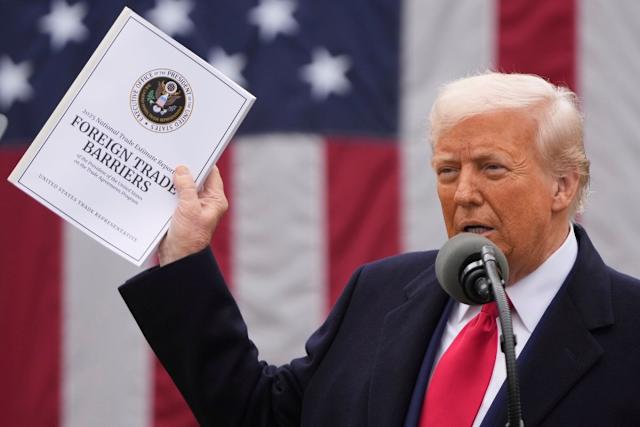

Trump Declares Economic Victory

President Trump, never shy to tout the results of his economic agenda, emphasized that the “big money” is only beginning to pour in. With higher “reciprocal tariffs” on the horizon, starting August 1, the president expects even greater financial returns in the months ahead.

Treasury Secretary Scott Bessent supported Trump’s optimism, stating on X, “America is reaping the rewards of Trump’s tariff policies — and with no inflation!” He highlighted that this budget surplus reflects America’s growing economic independence and strength.

June Deficit Turns into Surplus

The numbers don’t lie. In June 2024, the federal government suffered a $71 billion deficit. Fast forward to June 2025, and the administration posted a surprise $27 billion surplus.

This turnaround was powered by a 13% jump in total receipts, which reached $526 billion — a record for the month. Government outlays also fell by 7%, totaling $499 billion.

Although calendar-based adjustments suggest an “underlying” $70 billion deficit, the raw data points to a sharp shift in fiscal momentum.

Record Revenue Meets Soaring Outlays

Year-to-date receipts rose 7%, or $254 billion, to $4.008 trillion. This growth was largely fueled by higher withheld income taxes — a direct result of rising employment and wages.

However, the government’s spending continues to climb. Outlays have increased by 6%, or $318 billion, to a total of $5.346 trillion.

Healthcare programs, Social Security, defense, and Homeland Security all saw funding hikes. Most notable was the Treasury’s interest on the national debt, which grew to a staggering $921 billion in nine months — now the single largest individual federal expense.

Average Interest Rate Levels Off

Despite the swelling interest payments, the Treasury’s average interest rate has stabilized. At the end of June, it stood at 3.3%, just two basis points higher than last year.

This plateau may provide breathing room, but any future hikes could place more pressure on the national budget.

Tariff Revenue to Climb Even Higher

Bessent recently projected that calendar-year customs collections could reach $300 billion by the end of 2025. At June’s current pace, annual gross collections would hit $276.5 billion.

That target may require higher tariffs — and that’s exactly what’s coming. Trump announced 50% duties on copper and goods from Brazil, and a 35% tariff on Canadian imports, all beginning August 1. Sector-specific tariffs on semiconductors and pharmaceuticals are also expected soon.

Economists Warn of Overreliance

While the Trump administration sees tariffs as a goldmine, some economists urge caution. Ernie Tedeschi of Yale University noted that consumers and companies are “front-loading” purchases to avoid future tariffs. Once that pattern fades, monthly revenue could spike even more — possibly by $10 billion.

However, Tedeschi warns of addiction: “There’s a significant risk that we get hooked on tariff revenue.” Over time, shifts in consumer behavior could blunt the long-term impact of these duties.

Conclusion: A Fiscal Turning Point

President Trump’s trade strategy has reshaped federal finances. With tariffs now generating over $100 billion and climbing, America’s economic outlook is seeing a dramatic shift.

Whether this trend proves sustainable or not, one thing is clear: the era of tariffs is back — and it’s paying off big.

For more latest news checkout our website: usnewsinsight